BioComp Dakota 3.0

WHAT IS BIOCOMP DAKOTA?

Swarm Adapted Trading Systems

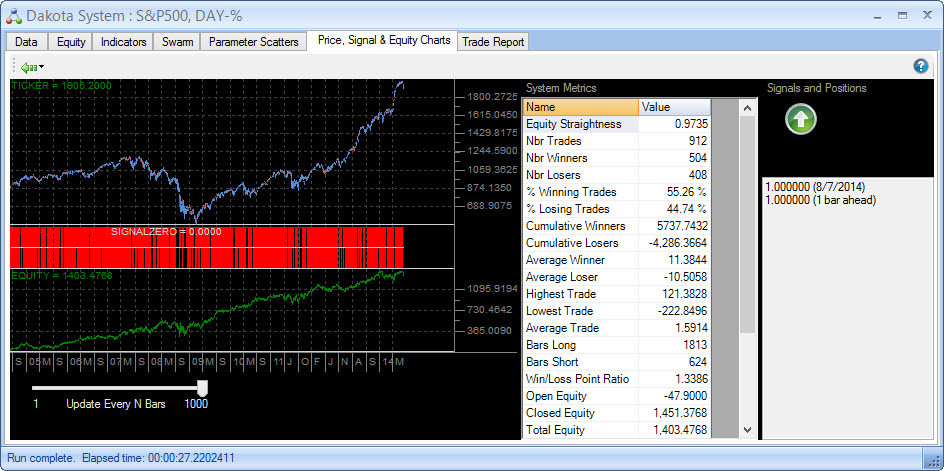

BioComp Dakota enables you to create and use adaptive trading systems with 100% walk-forward out-of-sample performance evaluation. Dakota "steps-forward" one bar at a time, recalculating signals as though you were trading in real-life. Dakota's results show you the truth about your trading systems before and while trading them.

Create Adaptive Trading Systems

"Adapt or Die" they say. Perhaps the wording is a bit strong, but it's true, especially in the financial markets. What is driving the markets is constantly changing, shifting, moving about. A lot of systems start out performing well, however they don't change with the times and their performance erodes as a result. You need something in your arsenal of tools that adapts, shifts and tracks equity performance.

Why is Dakota Different?

BioComp Dakota uses "Swarm Technology"(tm) to adapt the parameters of programmed trading systems to shifting market conditions in an attempt to create and maintain Dakotaable market timing signals, that is, when to buy, sell or exit from the markets in a Dakotaable manner. Dakota uses Swarm adaptation technology, not optimization. You don't want Swarm Optimization which "jumps" from one set of trading system parameters to another, but adaptation, where the swarm tracks performance smoothly. Systems with Swarm Adaptation algorithms are rare as most Swarm Technologies are focused on ill-fated optimization.

Highly Customizable

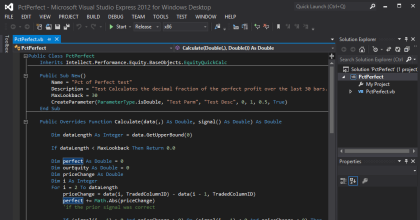

Dakota enables you to create unique solutions through the many types of data you use, pre-processing, bot types, different forms of initialization, performance metrics, trading system parameter adaptation algorithms, how signals are merged from multiple instances of the selected trading systems, parallel swarms of trading systems and the ability to have parent-child swarms and the ability to move trading systems about between swarms. If you can program in Visual Basic or C# using Microsoft Visual Studio Express (Free from Microsoft) you can create your own customizations. The possiblities are literally endless.

Robustness Verification

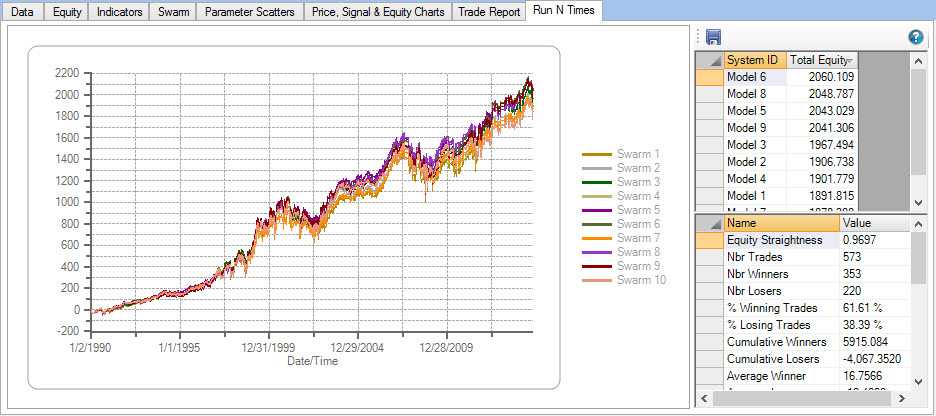

Various features enable you to check the robustness of your systems, including "Run N Times" for a walk-forward repeatability study and the "Ticker Bot Explorer" that enables you to see equity performance across a range of parameters to find sweet spots and avoid equity holes. Run N Times shows you the robustness of your system by re-walking it forward 10 times with different parameter initializations and a bit of randomness in the adaptation.

KEY BENEFITS

Swarm Adapted Trading Systems

Buy

Get a license to Dakota in a one time fee. Click the button to head to the store.

Buy Dakota! >>KEY FEATURES

What we deliver to you

TECHNICAL REQUIREMENTS

What kind of computer do you need?

BioComp Dakota has the following technical requirements:

- Works on XP, Vista, Windows 7, Windows 8/8.1 and Windows 10

- 4 GB RAM minimum, 8-16 GB is typical

- Minimal hard disk space to install

- Uses .NET 3.5

- Internet connection required to activate and to easily move your license from one machine to another

Dakota 3 is a great product.

I've been able to do a lot with Dakota 3. Love the framework..

I think BioComp Dakota is a better approach because it is all forward testing

DISCLAIMER: BioComp Dakota is not a trading system. It is a software tool for creating market timing systems. BioComp Dakota's output is not, and should not be considered, trading advice. This web page and others associated with it on this web site may make statements regarding performance of market timing systems created using BioComp Dakota or for trading and/or trading systems to which BioComp Dakota may contribute information. This performance is hypothetical or, such in the case of performance statements by customers or members of the press, cannot be or have not been substantiated by records of actual trading and thus must be treated as hypothetical. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve Dakotas or losses similar to those shown.